Stop Paying 4%! Your Simple Guide to Securing the 0.125% DLD Transfer Fee with TAP Fiscal

If you own property in Dubai, you know the standard transfer fee is a huge 4% of the property’s value. But there’s a simple, legal way to cut that cost down to a tiny 0.125% when you’re moving property to family or within your own company structure.

This massive discount is called a Property Gift Transfer (Hiba), and it’s the smartest way to protect your wealth—but only if you get the paperwork 100% right.

Comparison: Gifting vs. Sale Transfer

The difference between paying 4% and 0.125% is that you save huge amounts of money instantly.

| Transfer Type | What It Means | DLD Fee |

Standard Sale | Selling your property to a buyer. | 4.00% |

| Gift Transfer (Hiba) | Gifting property to family or your 100% owned company | 0.125% |

Example: If your apartment is valued at AED 5 million, you save AED 193,750 instantly by using the gift transfer rule. If you mess up the paperwork, the DLD charges you the full 4%—a very expensive mistake!

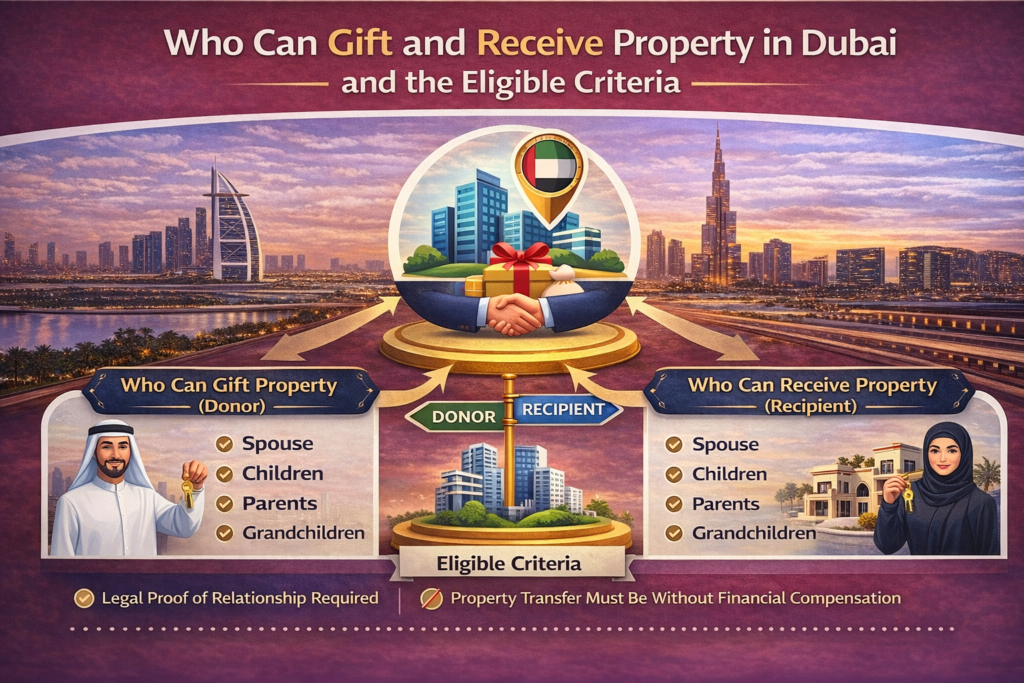

Who Can Gift and Receive Property in Dubai? Who is Eligible for Property Gifting (Hiba) in Dubai?

The discounted 0.125% rate is highly restricted to secure assets within close circles.

1. Immediate Family (First-Degree Relatives)

- Simple Rule: The discount cannot be used for siblings, grandparents, cousins, or friends.

- Eligible: Spouse (Husband/Wife), Parents, and Children.

2. Corporate Transfers

- Eligible: Moving property between a person and a company they 100% own, or between two companies with the same Ultimate Owners and split.

DLD Restrictions on Property Gifting in Dubai

Before starting, confirm your property and situation meet these essential DLD rules.

1. Ready Property Only

Rule: Only ready properties with a clear title deed can be gifted. Off-plan properties usually cannot be gifted unless the developer explicitly issues an NOC.

2. Mortgaged Property Requires Bank Clearance

- Rule: The property cannot be transferred until the mortgagee bank issues a final NOC.

- Action Required: You must either pay the loan in full or the person receiving the property must qualify and take over the existing loan.

3. Only One Gift Allowed

- Rule: The DLD is unlikely to authorize more than one gift transfer on any single property to prevent misuse of the rule.

- Impact: If your property has been gifted before, the next ownership change will be a standard sale with the full 4% DLD fee.

Step-by-Step Process to Gift Property in Dubai

The transfer is executed at a DLD-certified Trustee Office.

Step | Action and Requirements |

| 1. Document Prep | Gather Title Deed, IDs, and the crucial proof of relationship (attested Marriage/Birth Certificates). |

| 2. Approvals | Obtain the Developer NOC and Bank NOC (if applicable). |

| 3. Valuation | The DLD must officially value the property to calculate the 0.125% fee. |

| 4. Final Signing | Both parties (Donor and Donee) attend the Trustee Office to sign the documents. |

| 5. Fee Payment | Pay the 0.125% DLD transfer fee plus Trustee and admin fees. A new Title Deed is then issued. |

Understanding Property Valuation for Gifts

The 0.125% fee is calculated based on the property’s value as assessed by the DLD, not the current market price. A mandatory Valuation Certificate is required from the DLD as part of the application process.

Special Cases and Considerations

| Scenario | Requirement | ||

| Foreign Documents | All foreign certificates must be officially stamped (attested) by the UAE Ministry of Foreign Affairs and legally translated into Arabic. | ||

| Corporate Gifting | Requires submitting heavy corporate documentation (Trade License, UBO proof, Board Resolutions) to confirm ownership remains unchanged. | ||

| Inheritance | Gifting ensures property transfer according to your wishes now, avoiding potential court disputes over inheritance rules later. |

Benefits of Gifting Property in Dubai

- Massive Cost Savings: Secure the 0.125% DLD fee, saving hundreds of thousands of Dirhams.

- Succession Planning: Transfer wealth to your immediate family seamlessly during your lifetime.

- Asset Protection: Corporate gifting allows you to optimize your legal ownership structure.

Reasons for DLD Application Rejection

These are the most common mistakes that lead to an application being rejected and the full 4% fee being enforced:

- Wrong Documents: Submitting non-attested or incorrect foreign certificates.

- Ignoring the Bank: Attempting to gift a mortgaged property without the bank’s written permission (NOC).

- Assuming Eligibility: Gifting to a sibling or friend (not a first-degree relative).

- Corporate Errors: Failing to provide clear, matching proof that the Ultimate Owner hasn’t changed.

Key Takeaways: Why TAP Fiscal is Essential

The biggest risk in a Hiba transfer is non-compliance. If any piece of paperwork is wrong, you lose the 0.125% discount and pay the full 4%.

TAP Fiscal specializes in guaranteeing two things: Compliance and Savings.

| TAP Fiscal’s Role (What We Do for You) | Why It Matters (Saves You Money & Stress) |

| Restrictions Manager | We manage the mandatory Bank NOC and ensure your property hasn’t been “double gifted,” protecting your 0.125% rate. |

| Compliance Expert | We handle all the tricky attestation, translation, and corporate paperwork, ensuring zero errors for DLD submission. |

| End-to-End Execution | We manage the DLD valuation, pay the correct fees, and handle the final signing, giving you complete certainty of the 0.125% fee. |

Let TAP Fiscal handle the flawless legal execution.

Frequently Asked Questions

What is the main cost difference between a gift and a sale?

A: A gift costs 0.125% of the property’s value. A sale costs 4% of the property’s value. That’s the main saving.

Can I gift a property to my best friend?

A: No. The discounted 0.125% rate is only for your immediate family (spouse, parent, or child). Any transfer to a friend is treated as a standard 4% sale.

Do I really need to hire someone for this?

A: Yes, if you want the 0.125% rate guaranteed. The paperwork is very specific. Any mistake means the DLD rejects the 0.125% discount and charges you the full 4% fee. An expert ensures your transfer is fast, compliant, and cost-effective.

How long does the process take?

A: Getting all the approvals, valuations, and the final transfer usually takes 3 to 6 weeks. Expert help is essential to keep this timeline moving smoothly.

Ready to secure your significant DLD fee discount?

Contact TAP Fiscal today to start your property gift transfer or corporate restructuring process.